Sample Template Example of Beautiful Excellent Professional Application For Setting up EOU Letter Format in Word / Doc / Pdf Free Download

Download Format

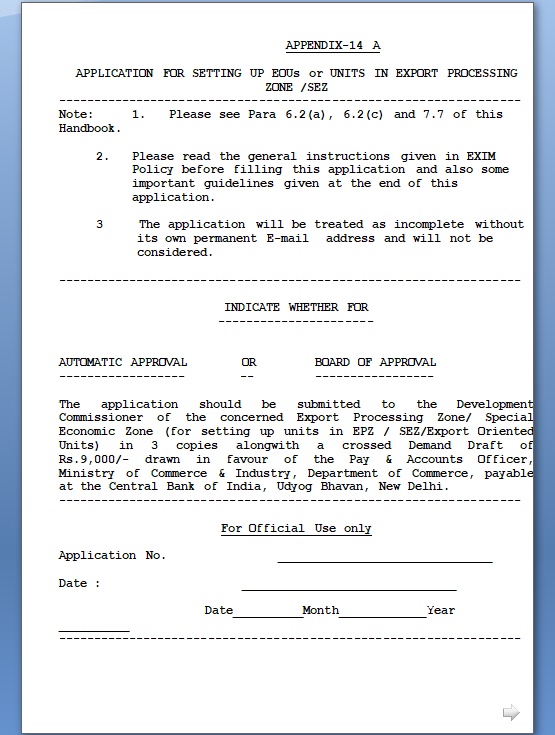

APPENDIX-14 A

APPLICATION FOR SETTING UP EOUs or UNITS IN EXPORT PROCESSING ZONE /SEZ

----------------------------------------------------------------

Note: 1. Please see Para 6.2(a), 6.2(c) and 7.7 of this Handbook.

2. Please read the general instructions given in EXIM Policy before filling this application and also some important guidelines given at the end of this application.

3 The application will be treated as incomplete without its own permanent E-mail address and will not be considered.

INDICATE WHETHER FOR

----------------------

AUTOMATIC APPROVAL OR BOARD OF APPROVAL

------------------ -- -----------------

The application should be submitted to the Development Commissioner of the concerned Export Processing Zone/ Special Economic Zone (for setting up units in EPZ / SEZ/Export Oriented Units) in 3 copies alongwith a crossed Demand Draft of Rs.9,000/- drawn in favour of the Pay & Accounts Officer, Ministry of Commerce & Industry, Department of Commerce, payable at the Central Bank of India, Udyog Bhavan, New Delhi.

----------------------------------------------------------------

For Official Use only

Application No. ______________________________

Date : ______________________________

Date__________Month____________Year __________

----------------------------------------------------------------

Details of Bank Draft

Amount Rs. ___________________

Draft No. ___________________

Draft date ___________________

Drawn on ___________________

(Name of the Bank)

Payable at ____________________

I. NAME AND ADDRESS OF THE

UNDERTAKING IN FULL (Block Letters)

Name of the Applicant Firm _________________________________

Full Address _________________________________

(Regd.Office in case of limited _________________________________

Companies & Head Office for _________________________________

Others _________________________________

Pin Code _________________________________

Tel. No. _________________________________

Fax No. _________________________________

e-Mail No. _________________________________

Income Tax PAN No. _________________________________

II. NATURE OF THE APPLICANT FIRM:

[Please tick (√ ) the appropriate entry]

Government Undertaking/Public Limited Company/Private Limited Company/Proprietor ship/Partnership/Others (please specify)

Note:-Copy of certificate of incorporation along with Article of Association and Memorandum in case of companies and partnership deed in case of partnership firms may please be attached.

III. INDICATE WHETHER THIS PROPOSAL IS FOR

[Please tick (√) the appropriate entry].

Establishment of a New Undertaking

- Manufacturing [ ]

- Services [ ]

Effecting Substantial Expansion

Manufacturing of New product

Conversion of (i) existing DTA unit into EOU

(ii)existing STP/EHTP to EOU/EPZ/SEZ

(in case of conversion, please attach fact sheet as per Annexure)

IV. (1) Location of the proposed undertaking

Full Address __________________________

Pin code __________________________

(2) ONLY FOR PROJECTS UNDER EOU SCHEME

(In case the unit is proposed to be located on leased premises, then lease should be obtained from Government or any undertaking / authority of Government)

(a) Please indicate if the proposed location is in a Centrally Notified Backward Area [Please tick (√) the appropriate entry].

No. ______________Yes_________________ If yes, indicate category

(b) Indicate whether it is within 25 kms from the periphery of the standard urban area limit of city having population above one million according to 1991 census.

Yes_____________ No. __________________

(c) Is it located in an Industrial Area/Estate designated/set up prior to issuance of Notification No. 477(E) dated 25th July,1991.

Yes_____________No. _____________

(d) If not, does it come under the category of non-polluting industries as notified by the Govt.

Yes ___________ No. _______________

V. ITEM(S) OF MANUFACTURE/SERVICE: (Including By-product/Co-products) (If necessary, additional sheets may be attached )

Item(s) Description Capacity(Unit=) Item Code(ITC HS Code No.) Not required for

service unit)

________________ ________________ _______________________

________________ ________________ _______________________

________________ ________________ _______________________

VI.PRODUCTION (In case of more than one item, supplementary sheets may be used)

Quantity (Unit __________) (Value (In Rupees)

Not required for service unit)

1st year ___________________ __________________

2nd year ___________________ __________________

3rd year ___________________ __________________

4th year ___________________ __________________

5th year ___________________ __________________

VII. Indigenous Requirement:

(Value in Rupees)

a) Capital Goods

b) Raw material, components, consumables,

packing material, fuel etc. during the

period of 5 years

TOTAL: ------------------------

------------------------

VIII. FOB VALUE OF EXPORTS

(1 $ = Rs.)

Rupees (lakhs) US $ (Thousand)

1st year | |

2nd year | |

3rd year | |

4th year | |

5th year | |

Total: |

IX. INVESTMENT:

(RS. IN LAKHS)

(a) Land ________________________

(b) Building ________________________

(c) Plant and Machinery ________________________

(I) Indigenous ________________________

(US $ Thousand)

(ii) Import CIF value ________________________

(iii)Total (I) + ii) ________________________

X. WHETHER FOREIGN TECHNOLOGY AGREEMENT IS ENVISAGED

(Please tick ( \/ ) the appropriate entry )

Yes ____________ No_____________

(I) Name and Address of foreign collaborator ___________

(ii) Terms of collaboration (Rupees lakhs)

(Gross of Taxes)

(a) Lumpsum payment _____________________

(b) Design & Drawing fee _____________________

(c) Payment to foreign technician _____________________

(d) Royalty (on exports ) _____________________%

(e) Royalty (on DTA sales if envisaged)_________________

(f) Duration of agreement ________________(No.of years)

XI. EQUITY INCLUDING FOREIGN INVESTMENT

(i)

($ Thousand) (Rs.lakhs)

(a) Authorized ________________ ________________

(b) Subscribed ________________ ________________

(c) Paid up Capital________________ ________________

Note: If it is an existing company, please give the break up of the existing and proposed capital structure

(ii) Pattern of share holding in the paid-up capital (Amount in Rupees)

(Rs. in lakhs) (US $ Thousand)

(a) Foreign holding _____________ _________________

(b) Non Resident Indian company / Individual holding

(i) Repatriable _____________ __________________

(ii) Non-repatriable _____________ __________________

(c) Resident holding _____________ __________________

(d) Total(a+b(i+ii)+c) equity_____________ ___________________

(e) (iii) External commercial Borrowing ______________ ____________________

Foreign Exchange Balance sheet

Total Total

1st 2nd 3rd 4th 5th (5 yrs)

In Rs./In Th

Lakhs / US$

XII. | FOB value of Exports in first Five years | |||||||

XIII. | Foreign Exchange outgo on | |||||||

(I) | Import of machinery | |||||||

(ii) | Import of raw materials and components | |||||||

(iii | Import of spares and consumables | |||||||

(iv) | Repatriation of dividends and profits to foreign collaborators | |||||||

(v) | Royalty | |||||||

(vi) | Lump sum know- how fee | |||||||

(vii) | Design and drawing fee | |||||||

(viii) | Payment of foreign technicians | |||||||

(ix) | Payment on training of Indian technicians abroad | |||||||

(x) | Commission on Export etc. | |||||||

(xi) | Foreign Travel | |||||||

(xii) | Amount of interest to be paid on external commercial borrowing/ deferred payment credit (specify details) | |||||||

(xiii) | Any other payments (specify details) | |||||||

Total (i)to(xiii) | ||||||||

Net Foreign Exchange earnings in five years | ||||||||

XIV. REJECTS(only for EOU/EPZ manufacturing units).

Generation of Rejects/Sub-standard ______________________

goods of the finished ______________________

(percentage of 5 yrs production)

Goods (In case rejects are more (Qty.(Unit = )

than 5% estimated percentage ______________________

with justification may be given ______________________

Value (Rs. Lacs)

XV. EMPLOYMENT

(All figures in number )

Existing Proposed

-------------- --------------

a) Supervisory Men_____________ Women____________

b) Non-supervisory Men_____________ Women_____________

XVI. NET FOREIGN EXCHANGE EARNING AS A PERCENTAGE OF EXPORTS/NFE

Percentage

Average NFE/NFEP on FOB value of exports in _________

5 years _________

XVII. MARKETING

a) Whether marketing tie-up/Buy-back ______________

envisaged/finalized?(Attach documents,___________

if any) Yes No

G. C. A. R. P . A.

b) Destination of exports(in percentage)_______ ________

_______ ________

XVIII OTHER INFORMATION

i) Any special features of the project proposal__________

which you want to highlight _________________

(please attach the project report, for new units)

_______________________

_______________________

_______________________

ii)(a)Whether the applicant has been issued any____________

industrial license or LOI/LOP under EOU/_____________

EPZ/ STP/EHTP/SEZ scheme if so, please _____________ give full particulars especially reference number,

date of issue, items of manufacture and

progress of implementation of each project.

(b)Whether the applicant has submitted any ____________

other application for LOI/LOP which is_______________

pending with the Board of Approvals.

If so, please give particulars like reference

number, name under which application

made, items of manufacture etc.

iii) Whether the applicant or any of the _________________

partners/Directors who are also partners______________

/Directors of another company or its

associate concerns are being proceeded

against or have been debarred from

getting any License/Letter of Intent/

Letter of Permission under the Export and

Import(Control)Act. 1947/Foreign Trade

(Development and Regulation)Act, 1992 / FEMA/

Custom/Central Excise Act.

Place:_________ Signature of the Applicant ____________

Date :________ Name in Block Letters ________________

Designation _________________

Official Seal/Stamp_________________Tel. No. _________________

e-mail _________________

Full Residential Address____________

UNDERTAKING

I/We hereby declare that the above statements are true and correct to the best of my/our knowledge and belief. I/We will abide by any other condition which may be stipulated by the concerned Development Commissioner. I/We fully understand that any Permission Letter granted to me/us on the basis of the statement furnished is liable to cancellation or any other action that may be taken having regard to the circumstances of the case if it is found that any of the statements or facts therein are incorrect or false. An affidavit duly sworn in support of the above information is enclosed.

Place:_________ Signature of the Applicant ____________

Date :________ Name in Block Letters ________________

Designation _________________

Official Seal/Stamp_________________Tel. No. _________________

e-mail _________________

Full Residential Address____________

SOME IMPORTANT GUIDELINES

1. Additional Information may be furnished by existing domestic units seeking conversion into the EOU/EPZ/SEZ Scheme as per annexure.

2. Normally raw material tie-ups are not insisted upon but this may be necessary incases, such as granite products where availability of raw materials is contingent upon Government leases etc.

3. Normally lumps sum amount up to US $ 2 Million and 8% royalty (net of taxes)as amended from time to time over a period of five years from the commencement of production is allowed as per the current policy on account of foreign technology agreement as per the norms of Department of Industrial Policy and Promotion. In addition selling agency commission is permitted as per RBI norms.

4. In cases involving high outgo of foreign exchange for capital goods and raw materials, the Government prefers raising of funds through external commercial borrowings.

ANNEXURE

PROFORMA TO BE FILLED IN BY THE EXISTING DTA UNITS SEEKING CONVERSION INTO THE EOU/ EPZ/ SEZ SCHEME

a) | Whether conversion of DTA Unit into the EOU/EPZ/SEZ has been sought for the full existing capacity of the unit or the proposal is for partial conversion.(Please give details of the existing capacity etc.) | |

b) | Whether any expansion of the DTA unit proposed to be converted into EOU/EPZ/SEZ has bee envisaged, if so the extent thereof.(Please give details of the existing capacity and the enhanced capacity etc). | |

c) | What is the level of existing exports of the unit proposed to be converted into EOU/EPZ/SEZ. (Please give details of export performance item-wise for a minimum of three previous years) | |

d) | Whether the DTA unit is already under obligation to export, under: i) Advance Licensing Scheme; ii)Import of machinery under EPCG scheme; iii)Any other Scheme. (Give all relevant details including total E.O. imposed, the E.O. discharged till date etc.) | |

e) | Whether your unit is registered with the Customs or Excise authorities. (Please give details viz. Reg. No., date etc.) | |

f) | Are you agreeable to have your whole unit customs bonded as required under the EOU/EPZ/SEZ scheme? | |

g) | Whether you are a merchant exporter or a manufacturer exporter.(Please give details) | |

h) | Whether manufacturing activity involved in the unit is within the ambit of section-3 of the Central Excise and Salt Act, 1944. | |

i) | What is the age(year of manufacture)and residual life items of machinery already installed in your unit, whether they are imported or indigenous.(Please attach separate sheets giving item-wise details with value of the new CG as well as existing value of machinery presently installed). |

Date____________Signature_____________ Name ___________________

Place __________Address of the Applicant

Download Format